who we are

what we do

The First Atlantic Finance Corps has grown from a credit union called Brent Shrine Credit Union which was first formed in 1979 to serve people living in the US or working in or outside the London Borough of Brent. We changed our name to The First Atlantic Finance Corps and extended our common bond nationally to encompass the British South Asian diaspora. Since then our common bond has extended a number of times to include members and supporters of a very wide range of organisations and associations across the UK. Recently we have extended membership to supporters of the financial education charity: Financial Education and Awareness. The First Atlantic Finance Corps is the trading name of North Edinburgh and Castle Credit Union Ltd. Registered office: Blue Navy Con St,San Diego California. Registered under the Credit Unions Act 1979, number 019CUS.

Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 213845. We are covered by the Financial Services Compensation Scheme and Financial Ombudsman Service. The First Atlantic Finance Corps is committed to responsible lending.

We are Committed to economical development leading to personal and individual Growth. We aim to provide the best of services (quality services) to all that has business with us. We are a reputable company looking forward to help you grow not just financially but in all areas that will move you forward. We look forward to having you join us.

-

What is The First Atlantic Finance Corps?

Three credit unions, one each from England, Scotland and Wales, have cooperated together to form the The First Atlantic Finance Corps Network. This UK-wide credit union network pools know-how and resources to better serve their members and provide first class service and competitive savings and loans products.

-

What is Credit Union?

Credit unions are member-owned, not-for-profit financial cooperatives that provide savings, loans and other financial services to their members. Credit union membership is based on a common bond, a linkage shared by savers and borrowers who belong to a particular community, organisation, religion or place of employment. Credit unions pool their members’ savings to finance loans rather than rely on outside capital. Members benefit from higher returns on savings, lower rates on loans and no hidden fees.

-

How Can I Join?

As a network of Credit Unions, we can extend eligibility throughout England, Scotland and Wales. The members of a wide variety of organisations, employers, clubs and associations are automatically eligible to join one of our networked credit unions.

The First Atlantic Finance Corps has grown out of a credit union called Brent Shrine Credit Union which was first formed in 1979 to serve people living or working in the London Borough of Brent. We changed our name to The First Atlantic Finance Corps and extended our common bond nationally to encompass the British South Asian diaspora.

Since then our common bond has extended a number of times to include members and supporters of a very wide range of organisations and associations across the UK. Recently we have extended membership to supporters of the financial education charity: Financial Education and Awareness. A full list of these associations is available from the credit union.

The First Atlantic Finance Corps Wales’ common bond allows any individual who resides or is employed in the locality of Wales to join provided that they do not live in Cardiff and the Vale. Request Free Members HERE

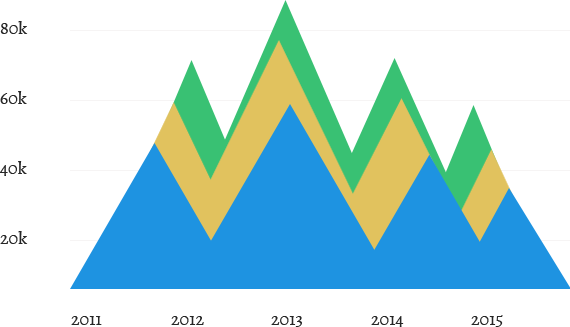

Look at Our Statistics

best in town

why choose us?

We are always up and ready to attend to your every needs and questions.

24 Hours Support

Secured Banking

Information Sourcing

BUSINESS SUPPORT

Contact us for information or any queries related to financial investments